Four Strategies to Manage Energy Costs

March 31, 2020

While cost savings are always a topic of interest, recent events have made them more of a priority than ever. Texas cities are seeing property tax limited by Senate Bill 2 while sales tax lags from the COVID-19 shutdown. Given these impacts to revenue, practical cost saving strategies are now critical.

One area of opportunity for all cities is utility cost. Electricity, gas, and water are all expensive line items in running city facilities. If a city has a wastewater treatment plant this cost increases exponentially, given the energy intensity of treatment systems.

To further exacerbate the issue, utility rates are likely to increase over time. This increase does not always happen at an even growth over time, but in sudden waves. Texas, for example, saw electric rates increase by over 20% between 2017 and 2018 when generation capacity was suddenly decreased. Water rates have also seen steep increases in many markets due to droughts in recent years combined with the costs of replacing aging infrastructure.

With the above in mind, this resource is designed to give you four simple strategies to managing energy costs. Several of these strategies can be implemented right away to see immediate cost savings. Others are long-term strategies that will reduce the impact of rising utility rates over time and minimize risk to your budget for years to come.

Let’s get started.

The single most effective strategy to offsetting cost is reducing usage. This is a straightforward approach, but it isn’t always easy. Your utility usage is the result of hundreds of decisions (how cold to set the AC, what time to turn it on each morning, did an employee turn off the lights when they left, etc.) and hundreds of pieces of equipment (motors, faucets, lighting, etc.). Trying to corral all of this without a planned strategy is tough!

Reducing usage should be a combination of behavior changes and physical upgrades. First, regardless of how old or inefficient a piece of equipment is, if it runs less it will use less energy. Tightening up schedules and encouraging conscientious habits with building occupants can go a long way to offsetting energy costs.

The second way to reduce consumption requires financial investment, but once in place will produce ongoing, guaranteed savings. All else being equal, a more efficient light bulb or motor will use less energy! Having standards to procure high-efficiency equipment as old units fail is a starting point. However, a comprehensive facility evaluation and equipment replacement project, such an Energy Savings Performance Contract (ESPC), will produce a bigger savings.

By combining the two strategies above, you can reduce your total cost even in a rising rate environment.

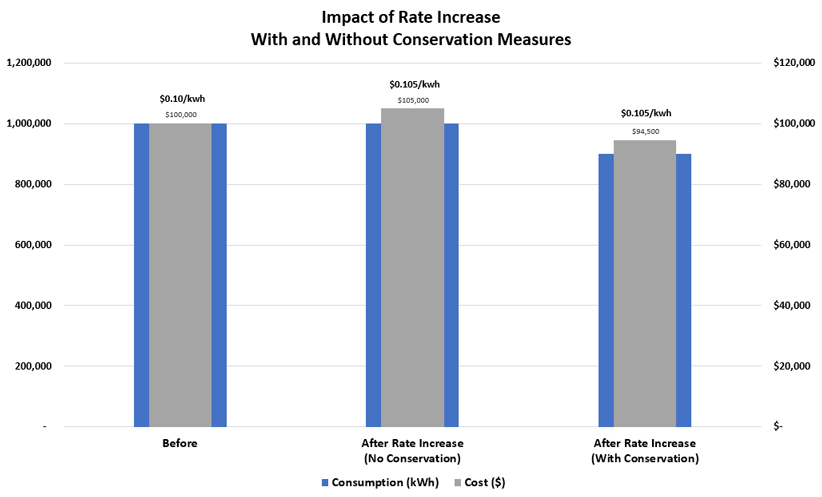

As an example, let’s say your current electricity bill is $100,000 based on usage of 1,000,000 kWh at a rate of $0.10/kWh. If rates increase by 5% (to $0.105/kWh), your bill will increase to $105,000 assuming the same 1,000,000 kWh consumption. However, if you first reduce electricity consumption by 10%, you will see the 5% rate increase on only 900,000 kWh instead of 1,000,000 kWh. This means your new bill will be $94,500. This is much better than the $105,000 it would have been with no efficiency measures!

Here in Texas, much of the electric cost is based on when you use power and not just how much. This means that using electricity on a weekday afternoon in the summer will cost you much more than the same electricity used in the winter. This often holds true even if you have a fixed price electric contract.

How so? Your electric bill is composed of both demand charges (KW) and consumption charges (kWh). In a deregulated state like Texas, you can lock in fixed pricing from a variety of retailers on your consumption rate (kWh), but the demand rates are set by the utility (more on this in Strategy #3). Demand rates are designed to help limit demand during times of peak usage, like a hot summer afternoon, so the utility grid isn’t strained.

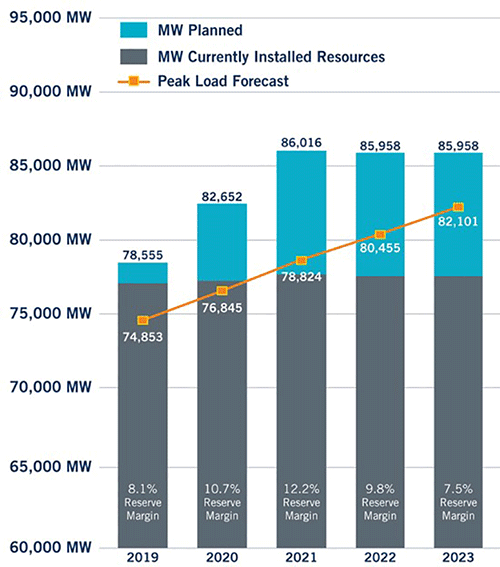

As you can see in the graph below from the Electric Reliability Council of Texas (ERCOT), Texas is forecasting very tight demand vs. supply in the coming years. This means demand management will become a more important factor in reducing cost in public facilities.

Figure 3

Due to the complex rate structures and timing involved, demand management is much more difficult than consumption management (Strategy #1). Once understood and implemented, however, you can greatly decrease your cost with little to no up-front financial investment. Reach out if this is a strategy you’d like help with.

We briefly mentioned “deregulation” above. Texas and many other states deregulated their electric utilities, which means consumers can competitively procure the commodity portion of their bill. Energy is traded on markets (like stocks) and companies are continually betting on long term prices going up or down. While you could ride the roller coaster of hourly price swings, almost no one does. Rather, you sign a contract with a provider for a fixed price over a certain term. Based on their prediction of what will happen over that term, your price will vary accordingly.

Moving beyond 12-month contracts will allow you to better forecast your upcoming utility cost as the consumption component of the bill will be locked in. Does this mean you should always go with a long (5+ year) utility contract? Not necessarily. The lower risk you desire for price swings, the higher the premium you pay for that risk reduction. The supplier is taking on risk betting that they can still buy power cheaper than they are selling it to you. The longer out the forecast is, the more uncertainty they have, so the higher the premium they charge to compensate. However, low future projected rates are making long term contracts both cost-effective and stable in some markets.

Utility procurement is not a simple science and engaging a consultant is wise. Their cost is often covered in the utility bill and a good consultant will more than pay for themselves by providing sophisticated models that minimize cost and reduce risk in the long term. If you need help in this area, sign up for a Strategy Session and I’ll be happy to go over it with you.

Solar contracts can be structured several ways. Some are long-term leases where you lock in a specific rate to purchase the power produced by the panels over a 15-20 year period. This is called a Power Purchase Agreement (PPA). On the other end of the spectrum you can pay cash for the panels and have “free” power as long as they run, reducing the amount that you have to buy from the grid. Each method has its benefits, but the concept is the same.

The first method is similar to our Strategy #3 above, as you are locking in a portion of your building consumption for a very long period. The second method has the same effect although the financials look different. For more information on solar financing, check out our resource articles on financing solar for schools and municipalities.

Let’s look at an example of a cash purchase.

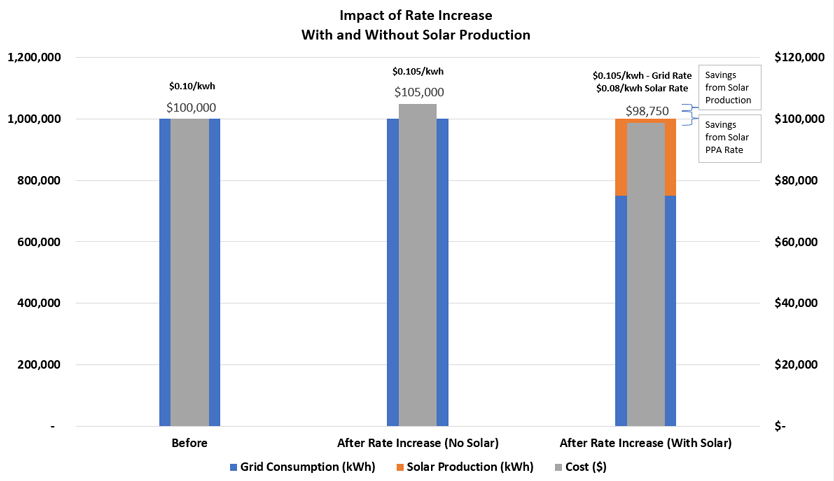

Let’s say your building currently uses 1,000,000 kWh and you are paying $0.10/kWh. Your current bill is $100k. You install solar panels that produce 250,000 kWh per year, 25% of your usage, with a PPA rate of $0.08/kwh. This means you purchase only 750,000 kWh from the grid. If grid electric rates increase by 5%, your bill will only increase $3,750 instead of $5,000. In addition, you’re seeing an immediate savings of 20% ($0.10 to $0.08) from the lower PPA rate.

What is even better about solar is that it also helps you with your demand management (see Strategy #2). In places like Texas, the solar panels produce the most when the grid is also strained the most (hot, sunny days in the middle of summer). Since you are offsetting more of your consumption during this time, you get an extra boost of benefit by reducing those super expensive demand charges. It is a double benefit of a well-designed solar system.

Lastly, solar often has PPA rates that are lower than your current grid rate, yielding immediate savings from day one. Note that if you decide to purchase your solar system outright rather than leasing through a PPA the benefits are similar. Essentially your solar energy will be “free” and you’ll just be paying for the cost of the equipment, whether up-front or through a debt payment.

Just like inflation, utility rates will trend up over time. However, with a good strategy that consists of some or all of the items above, you can beat the trend and see immediate reductions in your maintenance and operations (M&O) cost. We know this isn’t easy and would welcome the opportunity to create and implement a holistic plan for your institution. Please reach out and let us know how we can help!