The High Cost of Shared Savings Energy Conservation Projects

May 7, 2021

There’s a saying that goes something like “Nothing is more expensive than when it’s free.” While this could apply to many purchases, it can be especially true with energy conservation projects. Let’s dig into this more so you don’t end up overpaying for a “no-cost” project.

There’s no such thing as a free energy project. Unfortunately, that has not stopped some energy contractors and consultants from describing their projects as “no-cost.”

How so? Enter shared savings agreements.

Shared savings agreements say that rather than providing firm fixed pricing as the up-front cost of the project, the energy services company will take a portion of the generated savings over a certain portion of time. The idea is that you receive an immediate net cost savings and do not have to come up with any up-front capital or take out a loan to get the project implemented. Sounds like a win-win, right?

On the surface this sounds good, and most providers try to close the sale quickly before clients can think through the details. Before you sign on the dotted line though, let’s examine the risks of this type of agreement.

A shared savings agreement places the focus on how much money is saved vs. what the actual changes or improvements cost. Like a magician using distraction to fool the crowd, a shared savings salesman focuses on your out of pocket cost of $0.00 rather than true cost. This sleight of hand allows any amount to be charged so long as it’s less than the savings, regardless of the true cost of delivering the services.

Here is an example to illustrate the sales pitch:

Shared Savings Salesman: Mr. Client, you’re spending $400k/year on energy bills, and I can save you $100k at no cost to you. Just agree to give us 80% of the savings for the next 6 years and then you keep the rest forever! $20k/year net to you for 6 years and then you keep all the savings!

Client: Wow! That sounds good. $20k/year could do a lot for our budget. Where do I sign?

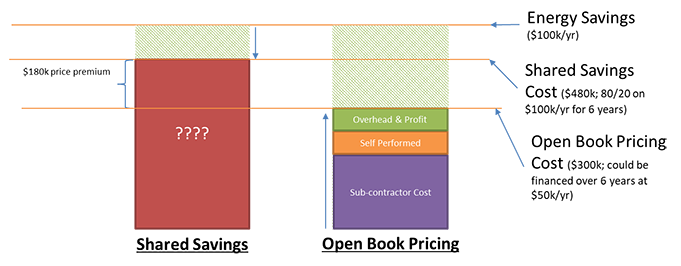

Just like that, the client signed a $480k contract (80% of $100k = $80k *6 years = $480k) that was “no cost.” The question is, was $480k a fair price?

How do you hire the best-qualified provider that will also provide the best value solution?

The best way is to structure an agreement that enforces a lot of transparency, which is the opposite of a typical shared saving agreement. Let’s look at another example from a salesman representing a transparent, open book pricing (OBP) approach.

OBP Salesman: Ms. Client, you’re spending $400k a year right now on energy, and we’re confident you can save 25% ($100k) by upgrading some equipment and improving your operations. We have obtained competitive bids on all the material and installation labor and broken out everything we will self-perform as individual line items. We have also broken out our overhead and profit margin so you have full visibility into how we calculated the price of the project. You can capture this $100k in annual savings with an investment of $300k, yielding a 3-year simple payback. What are your thoughts?

Client: Ok, I appreciate that. So, if I finance this over 6 years that’s $50k a year in cost vs. $100k in savings, putting $50k back into my operating budget. It looks like your costs are fair, and it’s a net savings for us so let’s proceed.

In this example the client kept an extra $30k (net of $20k vs. $50k) in annual savings by looking at the cost of the project through Open Book Pricing rather than just the savings (to keep the math simple we’re not factoring in cost of funds, etc.). Here’s an illustration.

One argument you might hear for shared savings is that the risk of underperformance is shifted from the owner to the contractor. They have “skin in the game.” The problem is, there is a lot of fat (excess profit) to cut through before you get to the contractor’s skin!

You can have the benefits of reduced risk and still get a low cost. The answer is Guaranteed Savings. In this case the contractor takes on 100% of the risk, without the excess fat (profit).

Guaranteed savings means that in our example the Energy Services Company would track actual savings and make sure you achieve the $100k annual reduction. If not, they’re on the hook to make up the difference.

While guaranteed savings might sound like shared savings, it has some practical differences with real-world applications. Perhaps most importantly, by guaranteeing a fixed amount of savings you avoid the issue of what to do with excess savings. Let’s look at why that is.

Many shared savings agreements focus on operational improvements rather than infrastructure improvements. These low-cost operational improvements are easy ways to save energy. Since they do not cost much, the energy services company self-performs, yielding high margins. Keep in mind that they are usually functioning as a “consultant,” with you still needing to invest time and staffing resources to implement the changes (equipment scheduling, setpoint changes, etc.). More on that later.

Back to our issue of excess savings: What happens if you as the owner decide it’s time to replace the aging HVAC in a building? Since new units will be much more efficient than the old units being replaced this can very well yield a 10-12% savings on your bill, let’s say $30k off your new annual utility cost of $300k/year

Who gets that savings?

Most shared savings agreements require you to share ALL savings with the contracted firm. This means $24k of the additional savings (80% of $30k) goes to the shared savings contractor even though they didn’t do anything to achieve it. This removes a lot of incentive for you to invest funds to upgrade facilities and yield savings.

Contrast this with guaranteed savings. In this case, your savings may go from $100k/year to $130k/year. Since the guarantee was $100k you keep all the extra $30k.

This example with equipment upgrades is one common situation, but there are other risks. Take for example the recent COVID-19 shutdowns. Utility costs took a big drop when all the buildings went unoccupied. Again, all that savings gets shared rather than going back to you as the owner. While a pandemic is a unique situation, we’ve seen clients that have had operational change like an event cancellation or schedule change and most of the resulting savings still end up going to the shared savings contractor.

As we said earlier, most shared savings agreements are focused on operational improvements with quick payback. The argument then becomes that once the agreement is paid for (typically 4-6 years) you still get all the savings for another 10-15 years.

The reality is it requires a lot of work to maintain an efficient operation. Without appropriate staff continually watching building automation systems, educating occupants, completing after hour audits, and managing standards there will be a quick bounce-back to the old inefficiencies.

A good operational program recognizes this from the beginning and factors the cost of your staffing into the equation. The goal of an operational energy consultant should be to establish a program and train staff so that you can maintain the savings after they are gone. Anything that does not recognize the owner’s cost to maintain a program or requires continual contract renewals is cause for concern.

Energy Savings improvements are generally wise investments. Like any investment, care should be given prior to committing funds. Take your time, and do not get too focused on the savings side of the equation at the expense of higher cost. Using transparent open book pricing and partnering with a firm that looks at both operational and infrastructure-related items is perhaps the best way to ensure you have a holistic program that maximizes value at the lowest possible cost. A good program can certainly offset its cost through savings, but don’t let that cause you to overpay!

If you have questions about energy savings conservation projects, please reach out by filling out the form below!